There may be instances in which you need to exempt a WooCommerce store customer from paying taxes. This could be due to a number of factors, such as the user being a wholesaler or being in a tax-exempt region. WooCommerce makes it easy to exempt a user from taxes, regardless of the cause. This article describes how to configure a “tax-exempt wholesale user” in WooCommerce.

Before we get started, it is important to note that WooCommerce does not have the option to exempt users from taxes by default. However, this can be easily accomplished using the Wholesale for WooCommerce plugin. This plugin lets you create multiple user roles that can be exempted from tax accordingly.

Setting up Tax Exempt Status for Wholesale Users in WooCommerce

Assuming you have a WooCommerce store with products and customers set up, and that you have Wholesale for WooCommerce installed and configured, you are ready to set up your wholesale users.

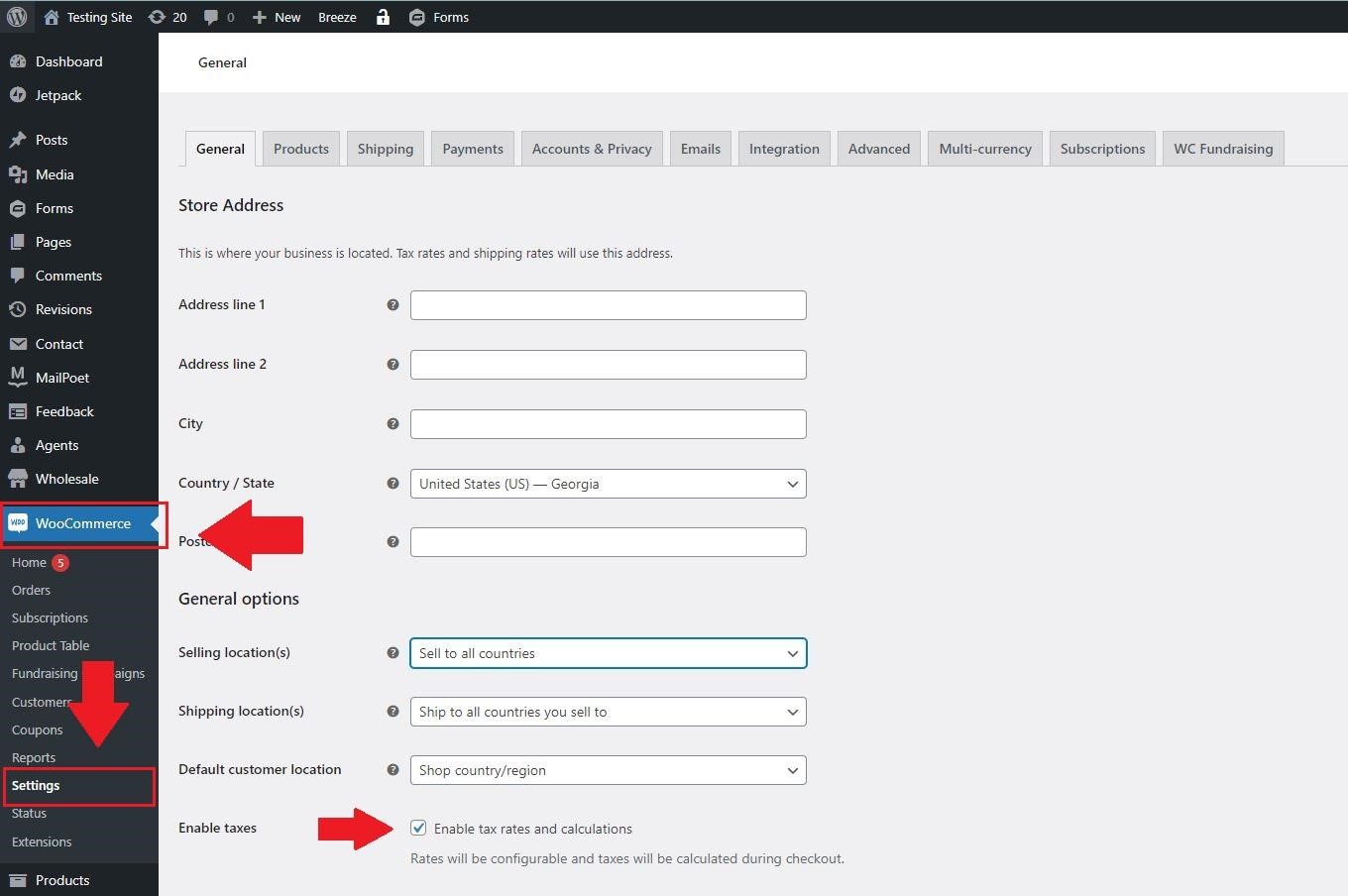

To do so, go to WooCommerce > Settings and click on the checkbox beside Enable Taxes. Click “Save changes” next.

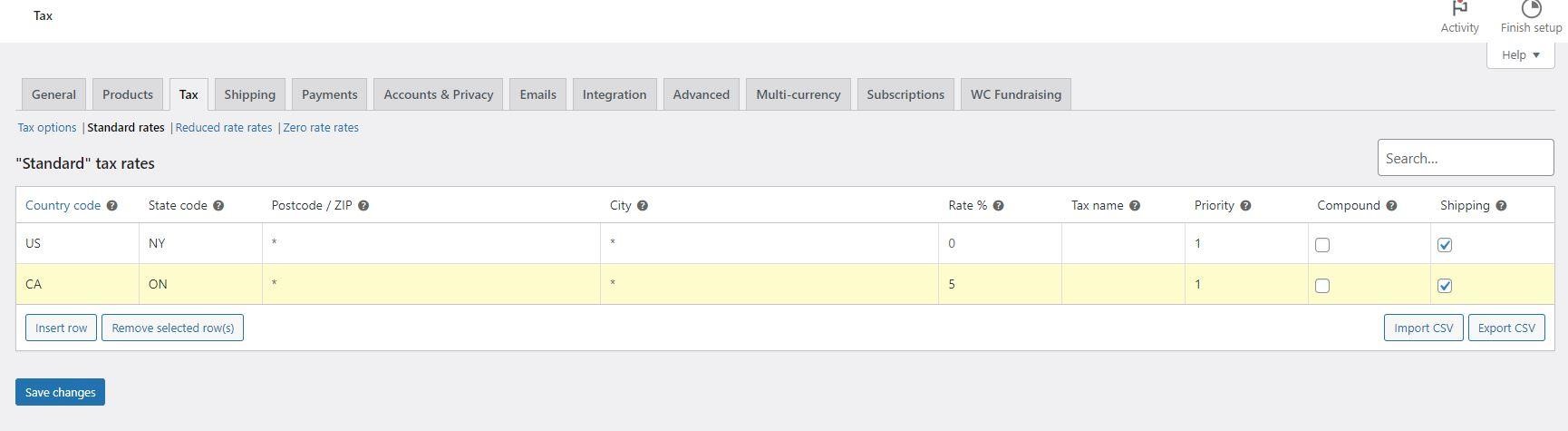

After that, the “Tax” tab will also appear, where you can add the tax rules.

Navigate to Tax > Standard Rates and add a new rate for each country you ship to. For example, if you ship to the United States, add a new row and select “United States” from the Country dropdown. Then, in the State field, enter the two-letter abbreviation for the state/province/region that the customer is located in. In the Zip code field, enter the customer’s shipping address’s zip code or postal code. Finally, in the Rate (%) field, enter “0” (zero) – this will make sure that no tax is applied to orders placed by wholesale users.

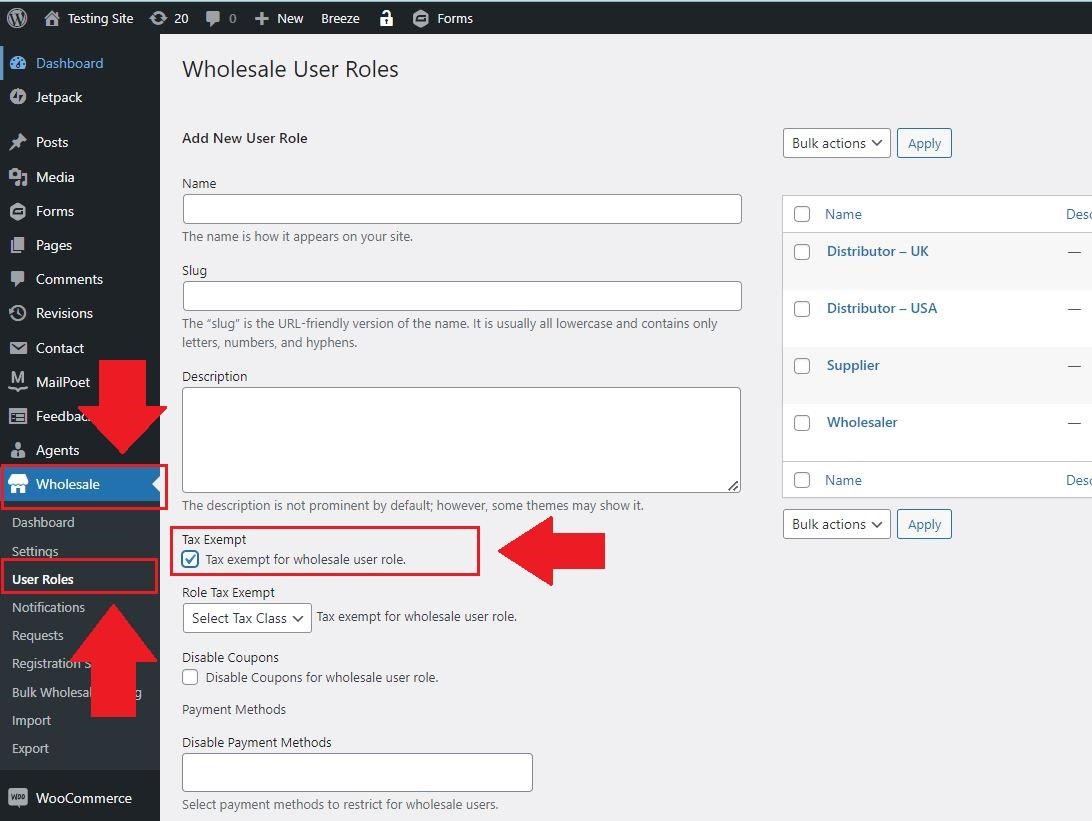

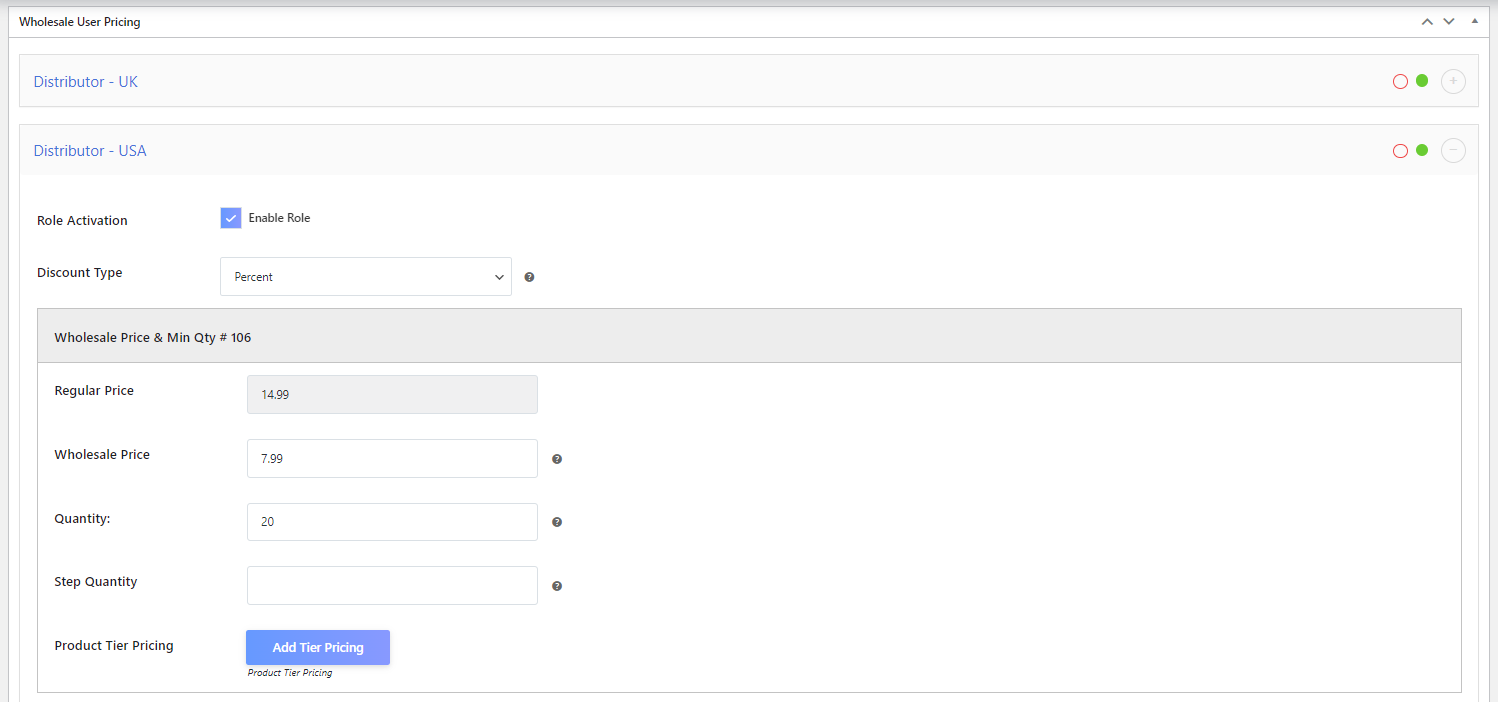

Now that you have your tax rates set up go to Wholesale > User Roles. On this page, you can create different user roles. You have the option for tax exemption for all users you’ll assign with the user role you create.

And that’s it! You have successfully set up tax-exempt status for your wholesale users in WooCommerce.

What’s the Difference Between a Tax Exempt and a Taxable User?

When it comes to taxes, there are two types of users in WooCommerce: taxable and tax-exempt. Taxable users are subject to all applicable taxes, while tax-exempt users are not. So, what’s the difference between the two?

Taxable users are required to pay taxes on all purchases made through WooCommerce. This includes state and local taxes and any applicable sales tax. On the other hand, tax-exempt users are not required to pay any taxes on their purchases.

How To Configure Product Prices for Wholesale Users?

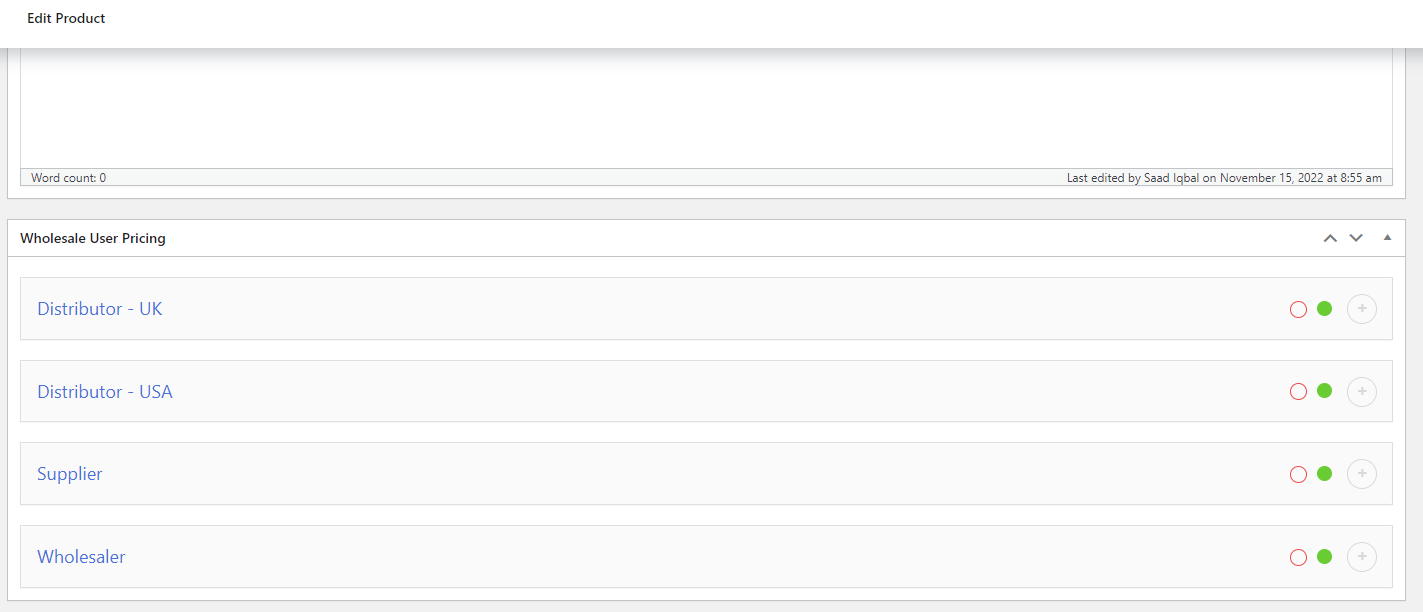

If you’re running a WooCommerce store and have wholesale customers, you may need to configure your product prices for them. This can be done easily by opening any product page.

First, go to Products > All Products. Then, select the product by clicking “edit” underneath the product.

This will take you to the product’s settings page. Here, you can set wholesale prices for the product.

Also, thanks to Wholesale for WooCommerce, you can easily set a different price according to the user role you assign to your users. Tax will be exempted for user roles that you’ve chosen to exempt. Alternatively, you can offer discounts to buyers who purchase a certain quantity of the product.

Once you’ve entered your desired prices, click the “Update” button to save your changes. And that’s it! You’ve now successfully configured product prices for your wholesale users.

Tips For Making the Most of Your Tax-Exempt Setup

There are a few things to keep in mind when setting up a wholesale user as tax-exempt in WooCommerce. Here are some tips to help you make the most of your tax-exempt setup:

- Make sure your wholesale user is registered as a business entity with the IRS. This will ensure that they qualify for tax exemption.

- Apply for a Tax Exemption Certificate from the state in which your wholesale user is located. This needs to be done before you can set up their WooCommerce account not to charge tax.

- When creating their account in WooCommerce, be sure to set their user role to “Wholesale Customer” and check the “Enable Taxes” box under “Tax Options.” This will ensure that they are only charged taxes on orders shipping to addresses within the state of their business location.

- Provide the tax IDs of your wholesale customers in their online accounts. This can be executed by visiting their “User page and scrolling to the “Wholesaler Tax ID” section. Enter their tax ID here and save the changes.

Final Words

Setting up tax-exempt users in WooCommerce is easy. With proper guidance, you can easily configure your store to allow for tax exemption based on user roles and customer information. By following the steps outlined above, you’ll be able to give your wholesale customers a personalized shopping experience while ensuring their purchases are free from sales taxes. With WooCommerce and Wholesale for WooCommerce, setting up tax-exempt users has never been easier!